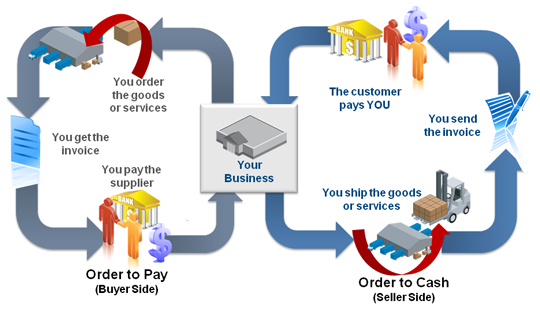

Invoicing cycles for buyers and suppliers

Depending on where you are in the invoicing process you will have a different perspective of electronic invoicing and the potential benefits. Buyers may wish to be able to pay quickly in order to take advantage of any early payment discounts available. This process is known as the order-to-pay cycle. For suppliers, the quicker the invoice can be processed the faster they can be paid for providing their product or service. This process is known as the order-to-cash cycle.

Improving the order-to-cash cycle

Suppliers continually strive to reduce their days sales outstanding (DSO), the amount of time it takes to receive payment from customers for the goods or services they provide. Once a supplier has shipped their goods or service, they want to be paid in a timely fashion. eInvoicing improves this cycle by:

- Ensuring the data quality of the invoice

- Removing the potential of data errors by removing the need to re-key data

- Reducing the time taken to deliver the invoice from days to minutes

- Enabling customers to automate the routing and settlement process

- Having fewer lost or missing invoices.

Improving the order-to-pay cycle

On the other side, buyers are concerned with ensuring that everything is in order before any payment is made. In this scenario, a company is receiving electronic invoices from many suppliers in the payables department. The company will check if the goods have been delivered in good order and will compare this to the original purchase order. If everything matches they will pay the supplier. e-Invoicing improves this cycle by:

- Automatically routing invoices for quicker approval

- Automated checking of invoice against other documents, such as purchase orders

- Reducing cycle times by over 60 per cent

- Facilitating the process of discount capture

- Reducing FTE (Full Time Employee) and processing costs.

Need any help?

One of our eInvoicing experts would be happy to answer any questions you have. Simply ask an eInvoicing expert »