VAT

Most countries apply a transaction tax referred to as a Value-Added Tax (VAT) or Goods and Services Tax (GST) to the sale of goods and services at each step (VAT) or at the end (GST) of the economic chain. For simplicity, the term VAT will be used to cover both VAT and GST in this section of the web site.

Any company that buys or sells goods or services in countries that have VAT must comply with each country’s tax requirements. Furthermore, each country that applies a VAT tax to goods and services needs to manage its own unique regulatory requirements for electronic invoices – e.g. rules for electronic signatures, the number of years electronic invoices must be archived.

For businesses that buy or sell goods in countries that apply VAT and who want to eliminate paper invoices in favour of electronic invoices, these are the main challenges:

- Different regulatory requirements in each country significantly increases the cost and complexity of compliance

- Non-compliance to the country-specific electronic invoicing regulations increases business risks associated with a tax audit, and in some cases, fines for both buyers and suppliers. Furthermore, the buyer may forfeit the right to reclaim VAT.

As a result of these challenges, many companies choose to comply via paper invoices and manual processes and miss out on the huge opportunity for cost savings and streamlined processes that can be derived from e-invoicing.

The Basics of VAT

This section presents a basic overview of VAT, how it works and what it represents to governments. These basics are not intended for tax experts.

The form and content of invoices (paper or electronic) are often regulated because invoices are the prime source of audit for Value-Added Tax (VAT). VAT was first introduced in the 1950s and quickly spread throughout Europe and to many other countries.

There are no global rules or any attempts at creating global rules for VAT. The EU (European Union) VAT system is the closest any region has come to a harmonised VAT system, but even in the EU rules are notoriously complex and diverse.

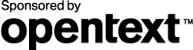

The basic principle of VAT is that the government gets a percentage of the value added at each step of an economic chain, which ends with the consumption of goods or services by an individual. While VAT is levied on business-to-business transactions throughout the chain, only businesses can deduct their input tax. Therefore, VAT requirements concerning invoices ordinarily only apply between businesses. (See Figure 1 – High Level VAT Collection Process below)

Tax authorities expect some minimum features to be present when auditing invoices – tax collection would be hugely inefficient if there were no base requirements on the form and content of invoices. For this reason, many countries have historically issued compulsory paper tax invoice templates to ensure uniformity of tax reporting. For the past decades, however, most EU member states have not been concerned with the form of paper invoices. Instead, these countries have focused on regulating the minimum content of invoices. Electronic invoicing processes, however, present a radical change to auditing practices. Because digital invoices by definition exist in complex technological environments where they are vulnerable to undetected change, tax authorities want to be sure that the electronic document itself presents certain minimum features for a cost-effective and reliable audit.

When an invoice does not meet a country’s minimum requirements, tax authorities can impose various sanctions. The buyer can lose the right to get any input VAT refunded. With the sanction potentially applying to all non-compliant invoices within the mandatory storage period (up to 10 years in some countries), this sanction could result in having to pay back many years’ worth of recuperated VAT– representing up to a quarter of the entire purchase value over that period. Both parties could also be fined, with fines ranging from absolute amounts per invoice to varying percentages of the value of the non-compliant invoice. Most countries have sanctions for the e-invoice itself being non-compliant, as well as for non-compliant storage. In extreme cases of negligence, even tougher sanctions may be available to some tax authorities.

Further information on VAT and the e-Invoicing Outlook

VAT is the predominant indirect taxing method globally and consequently a key factor in electronic invoicing is ensuring that each invoice is compliant with local tax authority regulations. This can be a complex challenge within Europe, but is increasingly becoming a global challenge, including countries such as Brazil and Mexico.

VAT ensures tax collection at each step of the supply of goods or services. The seller charges the value added tax, and is then responsible for paying the VAT to the tax authorities. At a later date, the buyer who has incurred the tax expense is entitled to recuperate the tax they were charged. This process occurs along the supply up to the point of sale to the consumer, who ultimately pays the tax. This is a serious matter for tax authorities globally as on average VAT revenues represent a third of a countries’ GDP. This system ensures a constant flow of tax revenue to government, and while not without fraud issues, discourages tax avoidance.

During a tax audit individual invoices can be required to prove a company’s accounts and it is because of the importance placed on this document that electronic invoicing regulations in VAT countries are designed to ensure the “authenticity of the seller” and the “integrity of the electronic invoice document”.

The European Union has the most focus on electronic invoicing today. The European Council has issued guidelines for some time now, first in 2001 and with amendments in 2006. The intention was always to provide clarification on what constitutes a compliant process and therefore to promote the wide adoption of electronic invoicing.

However, each member state in the EU has interpreted the guidelines in slightly different ways and this led to different tiers of complexity. Countries with prescriptive rules can insist on the highest levels of encryption and security, often tied to individuals within a company. Those countries with relaxed rules focus on the results offered and therefore only prescribe certain key elements of compliance and offer different methods of achieving the ultimate goal.

It is perhaps because of the levels of success seen in those countries with less rigid rules combined with the lack of adoption of electronic invoicing to this point that the European Council commissioned an expert group to provide recommendations on simplifying electronic invoicing further.

These recommendations have prompted another amendment to EC guidelines. The latest directive EU/2010/45, has recommended that electronic invoices are to be equally treated alongside paper by 2013. It is understood that the objective of the directive is to simplify electronic invoicing and increase adoption but it is causing confusion within the European marketplace.

An examination of the recommendations shows that the EC are promoting the less rigid approach as implemented by such countries as the United Kingdom. HMRC indicate that there are three methods for compliant eInvoicing;

- Electronic Data Interchange (EDI) in a VAN

- Digital Signatures

- “Any other means…”

By relaxing the rules, the EC have indicated that any electronic invoice, irrespective of format or delivery method can be said to guarantee authenticity and integrity if the invoice is supported by “reasonable business controls” and a “clear audit trail”.

What does this mean for companies doing business in Europe in 2013? Those evaluating an electronic invoicing solution today must be sure they are compliant tomorrow. There are two methods that have been consistently compliant for many years now, EDI in a VAN and digital signatures. These methods, applied correctly, can be said to guarantee compliance and they benefit from a long pedigree. The new systems that adhere to the “any other means” principle will be valid and will have their place, but their unfamiliarity to the tax authorities will place them under scrutiny for some time.

Basic VAT Q&A

-

[peekaboo_link name=”1″]Who/what is the taxable person?[/peekaboo_link]

[peekaboo_content name=”1″]

Taxable persons are legally independent, but closely bound by financial, economic, and organisational links which may form one taxable person, a VAT group. Generally, companies are taxable persons. The following is NOT considered a taxable person.

- Individual, even if s/he bears the VAT cost

- Passive holding company

[/peekaboo_content]

-

[peekaboo_link name=”2″]Is the supply item goods or a service(s)?[/peekaboo_link]

[peekaboo_content name=”2″]

The general rule is that if the supply item is considered

- Tangible, it is goods

- Intangible, it is a service

However, this is not always straightforward, in that it can depend upon the delivery, e.g., electronically or by carrier, or type of product, e.g., off the shelf or customised.

[/peekaboo_content]

-

[peekaboo_link name=”3″]Where does the supply of goods take place?[/peekaboo_link]

[peekaboo_content name=”3″]

Possibilities include

- Domestic, where the Supplier and Buyer are in the same country

- Cross-Border within the European Union (EU), where if it is

– Intra-community, it is VAT exempt

– An intra-community acquisition, it is VAT taxable and the Buyer is responsible - Cross-border to and from the EU where an import VAT is paid where the goods enter the EU. This amount is deductible as input VAT. Exportation is VAT exempt

[/peekaboo_content]

-

[peekaboo_link name=”4″]Where does the supply of services take place?[/peekaboo_link]

[peekaboo_content name=”4″]

Possibilities are

- Local, where, regardless of nature of the service, local VAT is due as soon as the service is supplied

- Cross-border, where, in general, services are taxed in the country where the (taxable) Buyer established. However, the applicable VAT can also depend on

– Status of the Buyer (business or Buyer)

– Nature of the service

– Location of the Supplier

– Location of the Buyer

[/peekaboo_content]

Need any help?

One of our eInvoicing experts would be happy to answer any questions you have. Simply ask an eInvoicing expert »